Global Tax Masters Sheds Light on MOOWR Scheme Benefits

New Delhi, [India], May 28, 2024: Global Tax Masters, an advisory firm renowned for its expertise in Customs and Foreign Trade Policy regulations, is on a mission to create awareness about the MOOWR Scheme, an initiative by the Central Board of Indirect Taxes (CBIC) aimed at fostering India’s status as a global manufacturing hub.

With over 15 years of commitment, Global Tax Masters has carved a niche by supporting clients and facilitating efficient guidance on customs regulations and the complexities of international trade policies. The firm’s dedication has resulted in substantial savings in Customs Duty and IGST under various duty-saving schemes, with a noteworthy achievement of assisting clients in saving import duties exceeding 1000 Crores under the MOOWR Scheme.

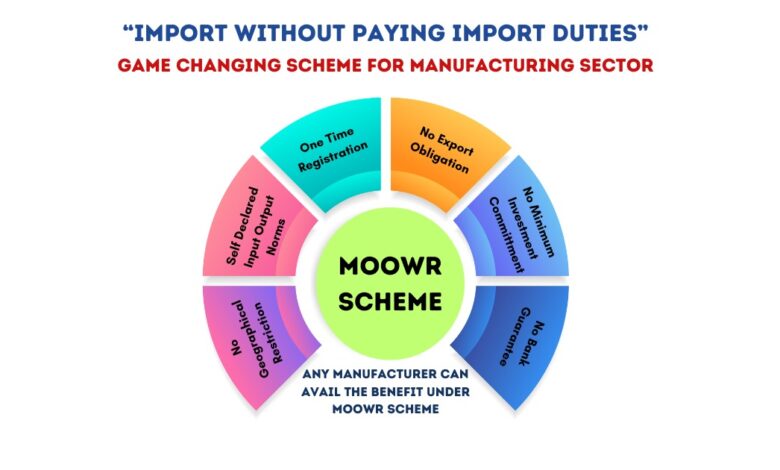

The MOOWR Scheme, also known as Bonded Manufacturing Scheme, enables the import of capital goods or plant and machinery without payment of duty for manufacturing and other operations in India. Under this scheme, the factory of the importer is registered with the Customs to enable the importer to import duty free in India. Only when the life of the machinery is over and it is removed from the factory premises, the import duty is required to be paid. Similar benefits can be availed for import of raw material for processing as well.

Highlighting the benefits of the MOOWR Scheme, Global Tax Masters emphasises the significant savings it offers on duties and taxes levied at the time of import. Basic Customs Duty, Integrated GST, Social Welfare Surcharge, GST Compensation Cess, and Anti-Dumping Duty are the duties and taxes that can be saved under this scheme. All types of machines such as CNC, injection moulding, laser cutting, laser welding, packing, complete manufacturing line, moulds, etc., can be imported duty free under MOOWR Scheme.

Unlike, EPCG Scheme, there is no export obligation under MOOWR Scheme. Further, compared to Advance Authorization Scheme, MOOWR Scheme offers more flexibility to the industry when it comes to time bound import and export and input output norms.

With a passionate team of Chartered Accountants, Company Secretaries, and Law Graduates, the firm ensures end-to-end support and transparency, catering to a diverse clientele of over 500 clients, including multinational corporations and prominent Indian companies.

Global Tax Masters offers the fastest services in the industry, budget-friendly solutions with no hidden costs, and expertise spanning Customs, GST, FEMA, and FTP under one roof.

For businesses engaged in regular imports and exports, Global Tax Masters extends its specialised advisory services, aiming to optimise benefits under various duty saving schemes. By leveraging its experience and in-depth knowledge of customs and foreign trade policies, the firm empowers businesses to navigate international trade, achieving significant cost efficiencies.

For further queries:

+91 8797010203